COVID and Consumers

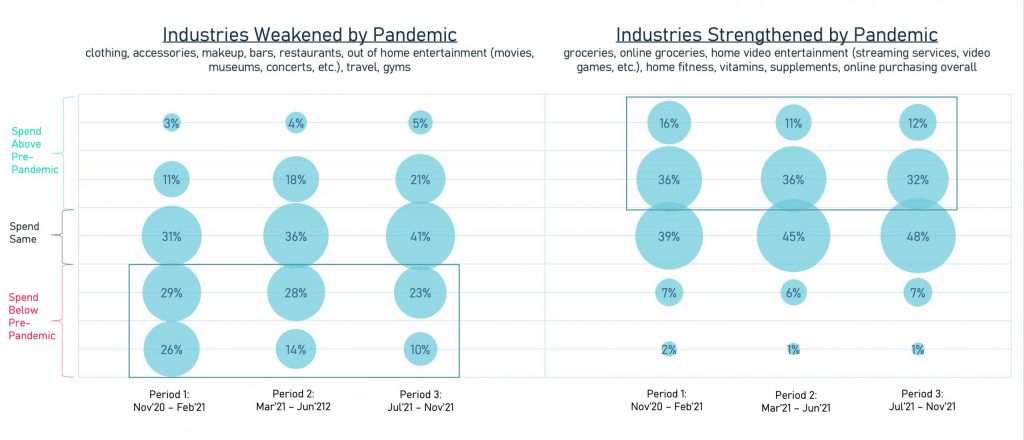

November 19, 2021 |Below is a breakdown of how respondents said they spent on selected product/services categories over the last year but relative to pre-pandemic. For those industries weakened by the pandemic, 55% of respondents reported spending below pre-pandemic amounts during the 1st Period (November 2020 – February 2021) when cases were highest. However, that number dropped to 33% as it currently stands (-22% difference). When looking at industries that were strengthened, 52% reported spending above pre-pandemic amounts during that same 1st Period. Currently, that number came down to 44% (a -8% difference).

In other words, products and services consumers were deprived of are recovering at a faster rate. It could also mean some of the habits consumers adopted in the strengthened categories during the pandemic are going to stick around for quite some time and possibly permanently. In addition, we can see that despite the rise in cases between the 2nd and 3rd period, progress towards pre-pandemic level spend continued. Meaning, that cases are no longer dictating consumer behavior as significantly as earlier in the pandemic.